Bitcoin Halving Countdown

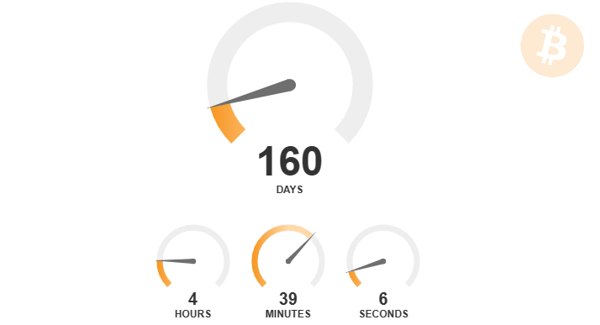

BTC Halving Countdown showing Days until the Next Bitcoin Halving Date.

157,625 Bitcoin blocks until the next BTC Halving Date

Bitcoin halving countdown is 1,076 days to the next Bitcoin halving occurring on Saturday Mar 25, 2028. Bitcoin halving countdown clock 2028 is based on the block time average for the last 20,160 blocks, currently at 9 minutes 50 seconds.

Bitcoin Halving 2024 Completed

The Bitcoin halving event completed successfully at block 840,000.

April 20, 2024

Bitcoin Halving 2028

Bitcoin halving 2028 date prediction for the next Bitcoin halving date at block 1,050,000. Halving 2028 is estimated to occur in 1,076 days sometime on March 25, 2028.

BTC Halving 2028 date is predicted to transpire on

Saturday Mar 25, 2028

at 08:49:30 PM UTC

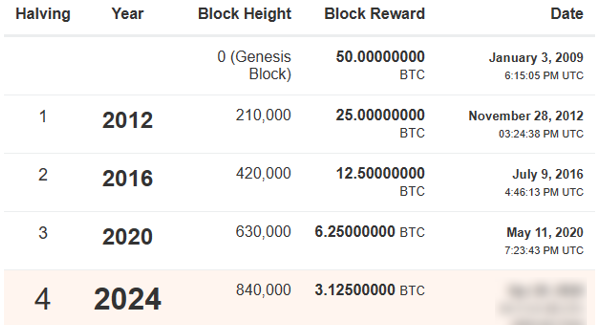

Bitcoin Halving Dates

Bitcoin Halving has taken place three times since its inception in 2009. The first halving date occurred on November 28, 2012, reducing the block reward from 50 BTC to 25 BTC. The second Bitcoin halving date took place on July 9, 2016, cutting the reward to 12.5 BTC. The third Bitcoin halving event happened on May 11, 2020, reducing the reward to 6.25 BTC.

The Bitcoin halving dates below list all the Bitcoin halving dates that have already taken place and the next Bitcoin halving date, as well as all future bitcoin halving dates until the block reward reaches zero.

All Bitcoin Halving Dates

| Halving | Year | Block Height | Block Reward | Date |

|---|---|---|---|---|

| 0 (Genesis Block) | 50.00000000 BTC | January 3, 2009 6:15:05 PM UTC |

||

| 1 | 2012 | 210,000 | 25.00000000 BTC | November 28, 2012 03:24:38 PM UTC |

| 2 | 2016 | 420,000 | 12.50000000 BTC |

July 9, 2016

4:46:13 PM UTC |

| 3 | 2020 | 630,000 | 6.25000000 BTC |

May 11, 2020 7:23:43 PM UTC |

| 4 | 2024 | 840,000 | 3.12500000 BTC |

April 20, 2024 |

| 5 | 2028 | 1,050,000 | 1.56250000 BTC |

Mar 25, 2028 08:49:30 PM UTC (PROJECTED) |

| 6 | 2032 | 1,260,000 | 0.78125000 BTC | |

| 7 | 2036 | 1,470,000 | 0.39062500 BTC | |

| 8 | 2040 | 1,680,000 | 0.19531250 BTC | |

| 9 | 2044 | 1,890,000 | 0.09765625 BTC | |

| 10 | 2048 | 2,100,000 | 0.04882813 BTC | |

| 11 | 2052 | 2,310,000 | 0.02441406 BTC | |

| 12 | 2056 | 2,520,000 | 0.01220703 BTC | |

| 13 | 2060 | 2,730,000 | 0.00610352 BTC | |

| 14 | 2064 | 2,940,000 | 0.00305176 BTC | |

| 15 | 2068 | 3,150,000 | 0.00152588 BTC | |

| 16 | 2072 | 3,360,000 | 0.00076294 BTC | |

| 17 | 2076 | 3,570,000 | 0.00038147 BTC | |

| 18 | 2080 | 3,780,000 | 0.00019073 BTC | |

| 19 | 2084 | 3,990,000 | 0.00009537 BTC | |

| 20 | 2088 | 4,200,000 | 0.00004768 BTC | |

| 21 | 2092 | 4,410,000 | 0.00002384 BTC | |

| 22 | 2096 | 4,620,000 | 0.00001192 BTC | |

| 23 | 2100 | 4,830,000 | 0.00000596 BTC | |

| 24 | 2104 | 5,040,000 | 0.00000298 BTC | |

| 25 | 2108 | 5,250,000 | 0.00000149 BTC | |

| 26 | 2112 | 5,460,000 | 0.00000075 BTC | |

| 27 | 2116 | 5,670,000 | 0.00000037 BTC | |

| 28 | 2120 | 5,880,000 | 0.00000019 BTC | |

| 29 | 2124 | 6,090,000 | 0.00000009 BTC | |

| 30 | 2128 | 6,300,000 | 0.00000005 BTC | |

| 31 | 2132 | 6,510,000 | 0.00000002 BTC | |

| 32 | 2136 | 6,720,000 | 0.00000001 BTC | |

| 33 | 2140 | 6,930,000 | 0.00000000 BTC |

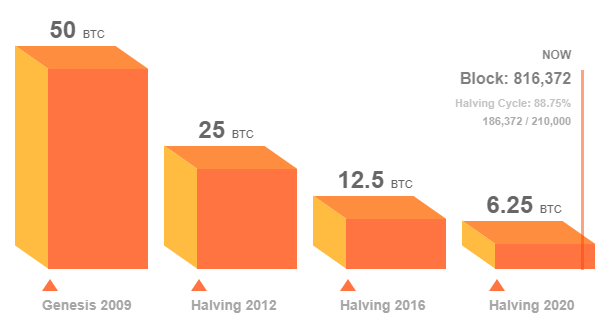

Bitcoin Halving Chart

Bitcoin halving cycle is a pre-programmed, algorithmic reduction in BTC rewards as visually shown below. The mining rewards given to Bitcoin miners is cut in half every 210,000 blocks or approximately every four years - at this halving date the block reward is reduced by half as visualized in the Bitcoin halving chart graphic below.

Bitcoin Halving Chart Years

Bitcoin Block Reward Schedule

Bitcoin Halving Dates History

The initial halving date occurred on November 28, 2012, cutting in half the block reward from 50 BTC to 25 BTC. The second halving transpired on July 9, 2016, reducing the reward to 12.5 BTC. Finally, the third halving occurred on May 11, 2020, resulting in a reduction of the reward to 6.25 BTC.

| Halving | Height | Block Reward | Date |

|---|---|---|---|

| 2012 | 210,000 | 25.000 BTC | November 28, 2012 |

| 2016 | 420,000 | 12.500 BTC | July 9, 2016 |

| 2020 | 630,000 | 6.250 BTC | May 11, 2020 |

| 2024 | 840,000 | 3.125 BTC | April 20, 2024 |

Bitcoin Halving Dates Future

The next Bitcoin halving in 2028 is the next event in which the reducing block rewards if cut in half. Subsequent halvings will follow until 2140 when rewards reach zero. This scarcity drives Bitcoin's appeal as a store of value.

| Halving | Year | Block Height | Block Reward | Date |

|---|---|---|---|---|

| 5 | 2028 | 1,050,000 | 1.56250000 BTC |

Mar 25, 2028 08:49:30 PM UTC (PROJECTED) |

| 6 | 2032 | 1,260,000 | 0.78125000 BTC | |

| 7 | 2036 | 1,470,000 | 0.39062500 BTC | |

| 8 | 2040 | 1,680,000 | 0.19531250 BTC | |

| 9 | 2044 | 1,890,000 | 0.09765625 BTC | |

| 10 | 2048 | 2,100,000 | 0.04882813 BTC | |

| 11 | 2052 | 2,310,000 | 0.02441406 BTC | |

| 12 | 2056 | 2,520,000 | 0.01220703 BTC | |

| 13 | 2060 | 2,730,000 | 0.00610352 BTC | |

| 14 | 2064 | 2,940,000 | 0.00305176 BTC | |

| 15 | 2068 | 3,150,000 | 0.00152588 BTC | |

| 16 | 2072 | 3,360,000 | 0.00076294 BTC | |

| 17 | 2076 | 3,570,000 | 0.00038147 BTC | |

| 18 | 2080 | 3,780,000 | 0.00019073 BTC | |

| 19 | 2084 | 3,990,000 | 0.00009537 BTC | |

| 20 | 2088 | 4,200,000 | 0.00004768 BTC | |

| 21 | 2092 | 4,410,000 | 0.00002384 BTC | |

| 22 | 2096 | 4,620,000 | 0.00001192 BTC | |

| 23 | 2100 | 4,830,000 | 0.00000596 BTC | |

| 24 | 2104 | 5,040,000 | 0.00000298 BTC | |

| 25 | 2108 | 5,250,000 | 0.00000149 BTC | |

| 26 | 2112 | 5,460,000 | 0.00000075 BTC | |

| 27 | 2116 | 5,670,000 | 0.00000037 BTC | |

| 28 | 2120 | 5,880,000 | 0.00000019 BTC | |

| 29 | 2124 | 6,090,000 | 0.00000009 BTC | |

| 30 | 2128 | 6,300,000 | 0.00000005 BTC | |

| 31 | 2132 | 6,510,000 | 0.00000002 BTC | |

| 32 | 2136 | 6,720,000 | 0.00000001 BTC | |

| 33 | 2140 | 6,930,000 | 0.00000000 BTC |

Bitcoin Halving Chart Dates

Bitcoin Halving Chart represents a graphical version of the historical and future halving dates and their impact on the block rewards for miners. This halving chart illustrates how the block reward is reduced by 50% during each Bitcoin halving, a pattern that is deflationary.

Bitcoin Halving Meaning & FAQs (Frequently Asked Questions)

Bitcoin Halving, is a fundamental event pre-programmed in to the Bitcoin protocol that reduces the amount of Bitcoin created for each valid block added to the Bitcoin blockchain. Approximately every four years or every 210,000 blocks, the block reward is cut in half, which is why this event is referred to as the Bitcoin halving event.

Futhermore, the Bitcoin halving dates are hard-coded and will last until the block reward for miners reaches zero or 0.00000000 BTC to be exact, which is expect to take place in the year 2,140.

This algorithmic reduction in the Bitcoin mining rewards given to Bitcoin miners for successfully validating and adding new blocks of transactions to the Bitcoin blockchain, has significant implications for the Bitcoin ecosystem.

During the Bitcoin Halving, the block reward is halved, meaning that miners receive 50% fewer new Bitcoins for their mining efforts. In the early days of Bitcoin, the block reward started at 50 Bitcoins, and after the first Halving in 2012, it was reduced to 25 Bitcoins. The most recent Halving took place in 2020, reducing the reward to 6.25 Bitcoins per block. The next Halving is scheduled for 2024, which will further decrease the block reward down to 3.125 BTC.

The purpose of the Bitcoin Halving is to control the inflation rate of Bitcoin. By reducing the rate at which new Bitcoins are created, it aims to limit the total supply of Bitcoin to 21 million, making it a deflationary digital asset over time. This event has historically had a profound impact on the Bitcoin market, often leading to increased demand and, subsequently, potential price appreciation.

Investors, miners, and the broader crypto community closely monitor Halving events due to their potential effects on the Bitcoin price and the overall crypto market. Traders and enthusiasts consider this event as a crucial factor in their investment strategies and market predictions.

The Bitcoin halving date should happen within few days of the predicted date, however if the Bitcoin hashrate increases by a large amount, the halving date will happen sooner.

The next Bitcoin Halving event is eagerly anticipated by the global cryptocurrency community and is scheduled to occur in 2028. As mentioned earlier, Bitcoin Halvings take place approximately every four years or after every 210,000 blocks are mined. This predictable and fixed schedule is an essential part of Bitcoin's core design, ensuring that new Bitcoins are created at a diminishing rate over time.

The most recent Bitcoin Halving happened in April 2024, which reduced the block reward from 6.25 Bitcoins to 3.125 Bitcoins per block. This event generated a lot of attention and speculation, as Bitcoin's previous Halvings were historically associated with significant price rallies. It's essential to note that while historical data may offer some insights, past performance does not guarantee future results, and the cryptocurrency market can be highly volatile and speculative.

The exact date and time of the Halving event can be calculated based on the number of blocks mined and the average block time, which is currently at block 892,375 with an average block time of 9 minutes 50 seconds - slower than the 10 minutes defined block time.

The most recent Bitcoin halving date took place on April 20, 2024. This marked the third halving in Bitcoin's history since its inception in 2009, and it had a significant impact on the cryptocurrency's supply and mining dynamics.

Bitcoin halving, is a predetermined event that occurs every 210,000 blocks or approximately every four years. Its primary purpose is to control the rate at which new Bitcoins are introduced into circulation, ultimately limiting the total supply to 21 million coins. This scarcity is a fundamental aspect of Bitcoin's design and one of the factors contributing to its perceived store of value.

During the last halving, the reward for miners was reduced from 6.25 BTC to 3.125 BTC per block. This reduction in block rewards has several important implications. First, it reduces the inflation rate of Bitcoin, slowing down the creation of new coins and increasing scarcity. This is in stark contrast to traditional fiat currencies, which can be printed by central banks in unlimited quantities, leading to inflation over time.

A Bitcoin halving countdown is a timer or a tool that helps people track the time remaining until the next Bitcoin "halving" event. A Bitcoin halving is a pre-programmed event that occurs approximately every four years (or after every 210,000 blocks are mined), reducing the rate at which new Bitcoins are created and added to the circulating supply.

During a Bitcoin halving, the number of new Bitcoins generated with each new block added to the blockchain is cut in half. The purpose of this event is to control inflation and ensure the scarcity of Bitcoin, which is often cited as one of its key attributes.

Bitcoin halving events are significant for the cryptocurrency and can have an impact on its price and overall market dynamics. As a result, we offer a Bitcoin halving countdown timer to help users keep track of when the next halving is expected to occur.

The countdown displays the number of blocks remaining until the halving event, as well as the estimated time remaining based on the current rate at which new blocks are being mined for the last 20,160 blocks or the last 10 Bitcoin difficulty retargets (10 x 2,016 blocks).

The next Bitcoin halving countdown is estimated to occur on Saturday Mar 25, 2028, in 1,076 days. The 2028 Bitcoin halving countdown clock, is 24.94% complete. Once Bitcoin block 1,050,000 is mined, this having cycle will finish and another halving will begin.

The Bitcoin Halving countdown is a valuable tool and visualization that helps you track the time remaining until the next Halving event, in this the next Bitcoin halving in 2028.

Bitcoin Halving takes place roughly every four years or every 210,000 blocks, as encoded in the Bitcoin protocol. This process will persist until the Bitcoin block reward reaches zero, expected around the year 2140.

The Bitcoin Halving occurs approximately every four years, or every 210,000 blocks. The havlings are coded in to the Bitcoin protocol and will happen until the Bitcoin block reward reaches zero sometime in the year 2,140.

The Bitcoin halving date shown is based the current block height and the average block time for the last 10 Bitcoin difficulty retargets or the last 20,160 blocks.

The average Bitcoin block time is 590 seconds for the last 20,160 blocks at block height 892,375.

The Bitcoin Halving is significant because it reduces the rate of Bitcoin creation, making it a deflationary digital asset.

The Bitcoin Halving event is a critical aspect of the Bitcoin protocol and holds substantial significance for various reasons. Firstly, it underscores Bitcoin's unique monetary policy, as it occurs approximately every four years and reduces the rate at which new Bitcoins are mined by half. This predictable and transparent supply adjustment sets Bitcoin apart from traditional fiat currencies, making it deflationary in nature and potentially more resistant to inflationary pressures.

Secondly, the Bitcoin Halving is a fundamental mechanism that helps maintain scarcity in the digital currency. With a capped supply of 21 million Bitcoins, the halving events act as built-in control over the issuance of new coins. This scarcity is often compared to precious metals like gold, which have historically been used as stores of value. As a result, the halving contributes to Bitcoin's perception as "digital gold" and can influence its attractiveness as a long-term investment and store of value in the cryptocurrency market.

The 2024 Halving reduced the block reward to approximately 3.125 Bitcoins per block. This reduction is part of Bitcoin's controlled supply mechanism, which aims to cap the total supply of Bitcoin at 21 million coins. It's worth noting that as the number of Bitcoins in circulation decreases and the demand remains constant or increases, the potential for upward price movement may also rise. However, market dynamics are influenced by various factors, and Bitcoin's price is subject to market sentiment, adoption, and external events.

Historically, Bitcoin Halvings have had a substantial impact on its price, with each event triggering remarkable price surges.

After the first Bitcoin Halving in 2012, the price increased multiple times, reaching levels that were previously unimaginable. Similarly, after the second Halving in 2016, Bitcoin's price surged again, further solidifying its reputation as a lucrative investment.

It's important to note that past performance is not a guarantee of future results, but the pattern so far has been one of increased interest and demand, driving up prices post-halving events.

This trend has been driven by the reduced issuance of new Bitcoins, which increases scarcity and can potentially create a sense of urgency among investors to acquire this limited asset, further fueling price appreciation.